In a factoring agreement, you give up some control over your accounts receivable process, which can be a significant disadvantage if you want to maintain tight control over your customer relationships.įor example, you may no longer be able to set your credit requirements or decide which customers to extend credit to. On top of these fees, you’ll also have to pay interest on your borrowing funds. Fees can vary depending on the company, but they often depend on your credit rating or how much inventory you hold. One of the most significant drawbacks to a factoring agreement is the cost.

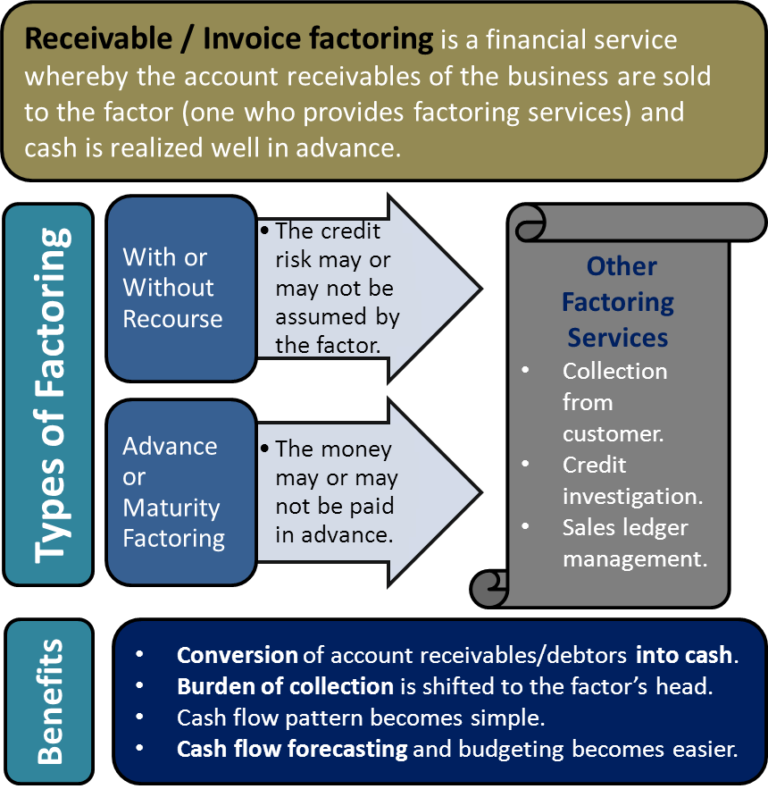

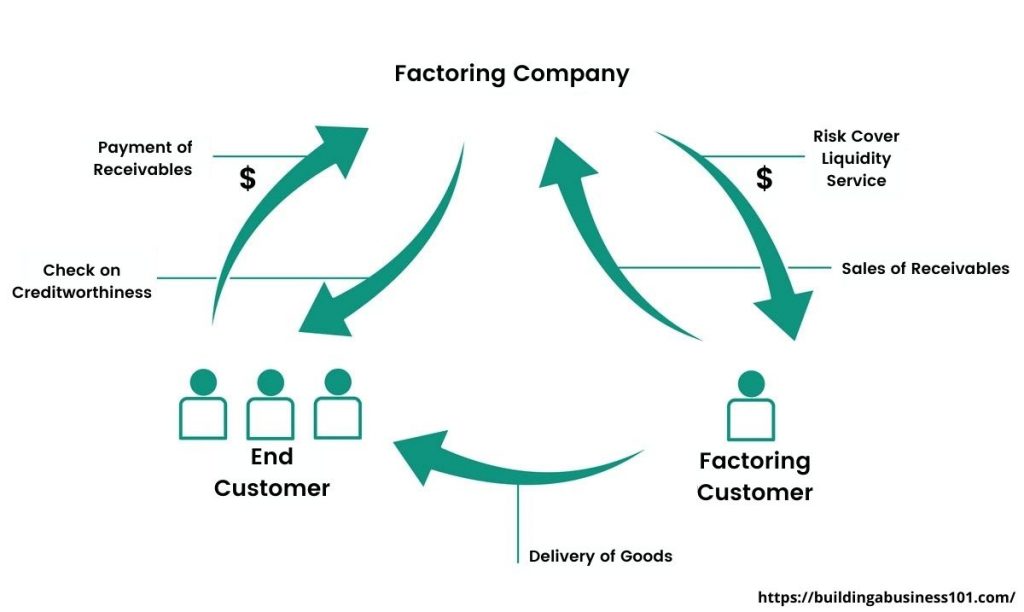

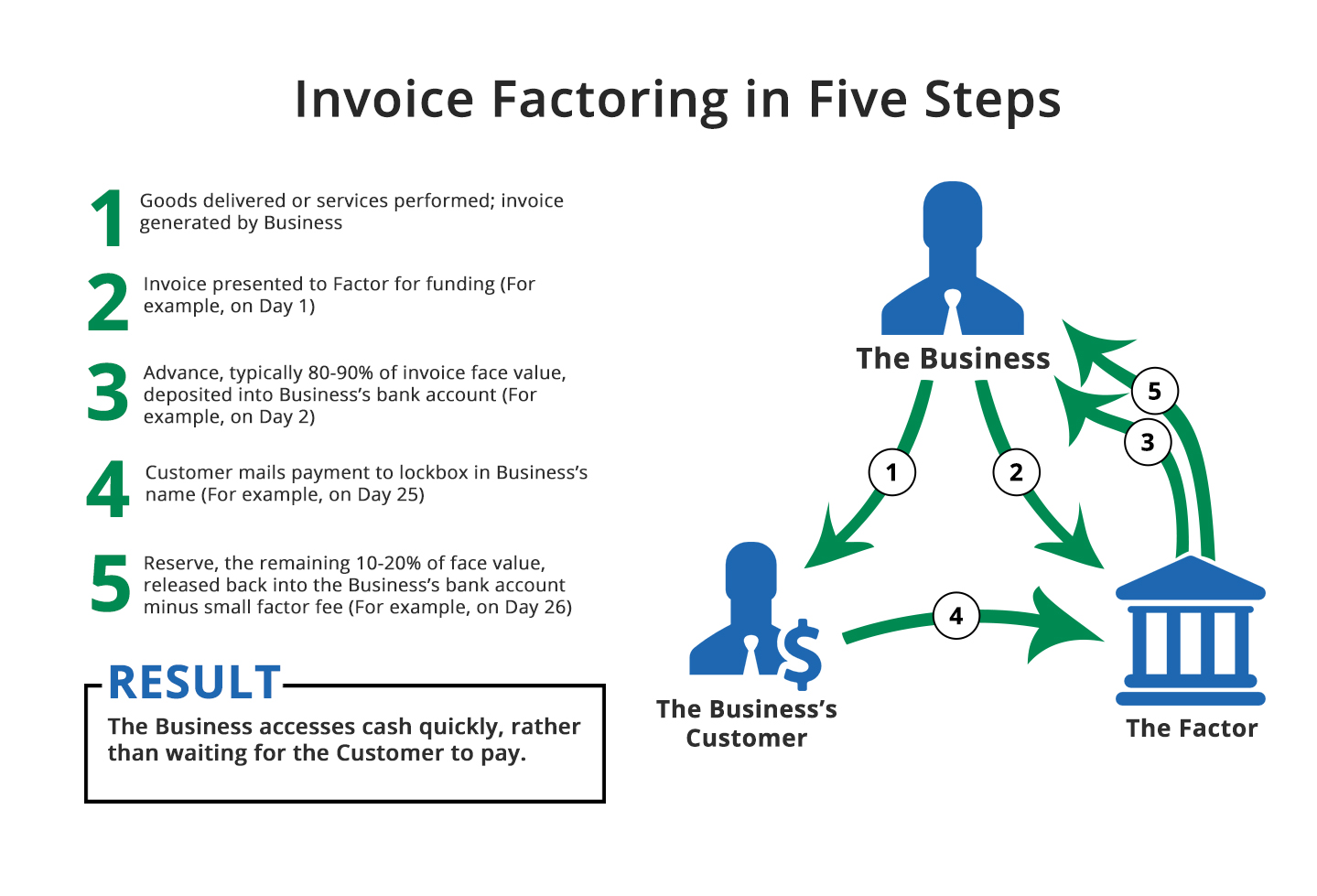

While a factoring agreement can be a helpful way to improve cash flow, there are also some drawbacks to consider. Both parties have the option of terminating the agreement at any time. The agreement will specify the contract term, which is typically one year but can be shorter or longer. Additionally, you will need to provide the factor with the contact information for your customer. You will need to notify your customer that the invoice has been assigned to the factor. The remaining balance will be paid to you when your customer pays the invoice. The factor will typically advance you a percentage of the invoiced amount, less the fees. The factor may also charge a monthly fee. This fee is typically a percentage of the invoiced amount and is paid when the invoice is. The factor will charge a fee for its services. You will need to provide the company with a list of your receivables and agree to sell them to the company for a specific price. The first part of the agreement involves the sale of your receivables to the factoring company. Here are a few of the primary ones: Sale and Purchase of Receivables The Primary Parts of a Factoring AgreementĪ factoring agreement has many parts. Such companies are often referred to as “high-risk” or “bad credit” customers because they have difficulty obtaining financing on commercially reasonable terms.īut factoring companies are willing to work with these businesses because they are interested in the company’s accounts receivable. However, it is beneficial for small and start-up businesses that have difficulty obtaining traditional financing. They help you with:Ĭompanies of all sizes use factoring.

#Invoice factoring template full

You then have to repay the company the full amount, plus interest.įactoring companies are strategic business partners who have experience working with small and medium-sized businesses. It is often used by companies that have difficulty obtaining loans from traditional lending institutions due to having a low credit rating or insufficient collateral.Ī factoring company purchases the right to a portion of your sales and then advances you the money before you receive payment from customers. Invoice factoring is the practice of loaning money against a company’s future sales or receivables.

Invoice Factoring and Factoring Companies

#Invoice factoring template how to

In this article, we’ll review what makes up a factoring agreement and how to protect your business against shady factoring providers. It’s very important to read your agreement carefully and thoroughly – not all factoring companies are 100% truthful in their sales process. This agreement will outline all details of the financing process. When you enter a relationship with a factoring company, you’ll sign an agreement. This is where invoice factoring can help, by turning your outstanding invoices into cash. It is also likely you’ll need to pay for goods and services before you have the cash to do so – things like payroll, for example. When you are a small business owner, your company will likely have a challenging time managing cash flow.

0 kommentar(er)

0 kommentar(er)